INDIAN MUTUAL FUND INDUSTRY ANALYSIS

The beauty of mutual funds lies in their ability to aggregate funds from a wide spectrum of investors, ranging from large institutions to individuals with modest savings. Even those willing to invest as little as 500 Rs per month can participate in mutual fund schemes, making it one of the most inclusive investment avenues available. The allocation of these pooled funds is guided by the objectives of the respective mutual fund schemes, which can vary from capital appreciation to income generation or a combination of both. Fund managers play a pivotal role in determining the allocation of funds, leveraging their expertise and market insights to navigate through different asset classes and sectors based on the prevailing economic conditions.

Despite facing numerous internal and external challenges, the Indian mutual fund industry has demonstrated remarkable resilience and growth over the past few decades. Internally, factors such as effective fund management, continuous product innovation, and the integration of technology have contributed to the industry's expansion. Externally, dynamics such as changes in interest rates, geopolitical shifts, and global economic trends have posed challenges but have also presented opportunities for growth and adaptation.

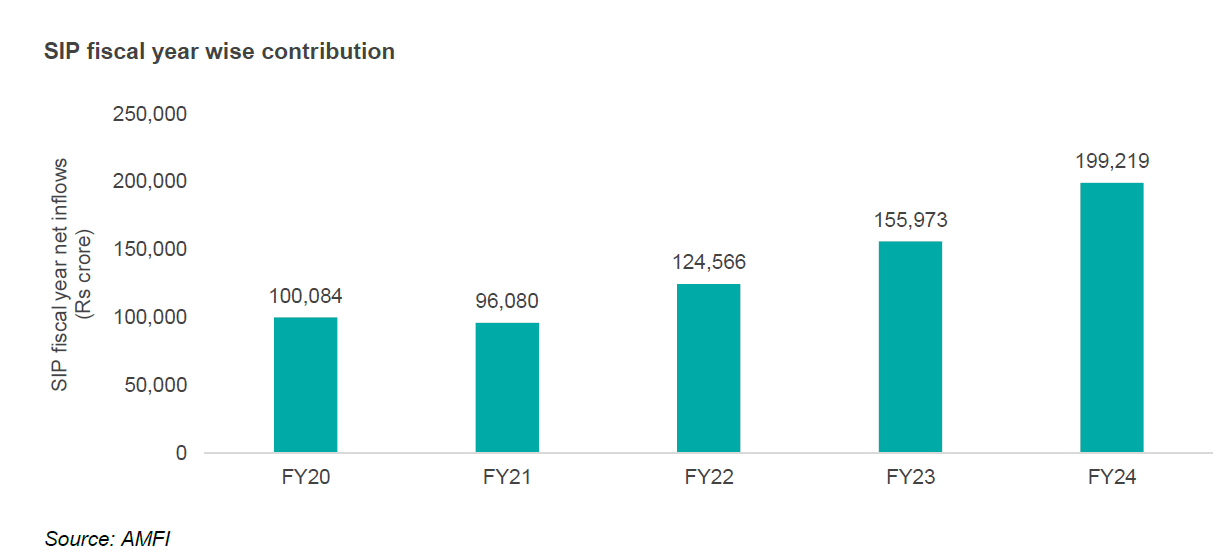

The Indian mutual fund industry has indeed witnessed remarkable growth over the past decade, with assets under management (AUM) soaring from 8 lakh crores to a staggering 50 lakh crores. This exponential rise can be attributed partially to the increasing participation from smaller cities across the country, which have shown the highest percentage growth in contributing to mutual fund AUM. Furthermore, the monthly systematic investment plan (SIP) contributions have surged from approximately 8,500 crores to 19,300 crores in just the last five years, indicating a growing trend of regular investing among retail investors.

Despite these impressive numbers, recent research conducted by Money Control reveals a significant gap between the investor base of mutual funds and that of the stock markets. While mutual funds boast an investor base of around 4 crores, the stock market investor base stands at nearly double that figure, at 8 crores. This stark contrast suggests a prevalent misconception among investors regarding the functioning and benefits of mutual funds, which may be hindering their adoption.

One major factor contributing to this misconception is the perception of mutual fund managers and the workings of mutual funds themselves. Many investors still harbor doubts or lack understanding about how mutual funds operate, leading them to opt for seemingly safer investment avenues such as bank fixed deposits. Moreover, those inclined towards risk-taking often explore avenues like futures and options (F&O) trading and digital assets, further diverting attention away from mutual funds.

To bridge this gap and reduce misconceptions, there is a need for greater education and awareness campaigns targeted at the masses, especially those in lower-income groups. Simplifying complex financial jargon and demystifying investment products can make mutual funds more accessible and appealing to a wider audience. Regulating bodies like the Association of Mutual Funds in India (AMFI) can play a pivotal role in this regard by promoting transparency and investor protection.

In addition to education, there is untapped potential in catering to the retail investor segment through debt funds. Many retail investors, particularly those seeking higher returns, overlook debt funds as an investment option. By emphasizing the tax benefits and risk diversification offered by debt funds, mutual fund companies can attract a broader investor base.

Regulatory interventions, such as those initiated by the Securities and Exchange Board of India (SEBI), have already made significant strides in safeguarding the interests of retail investors. Measures like reducing exit loads and enhancing transparency through standardized scheme information documents have boosted investor confidence in mutual funds.

Looking ahead, the focus should shift towards promoting sustainable investing strategies that prioritize long-term growth over short-term gains. Encouraging discussions on long-term perspectives and emphasizing the compounding benefits of staying invested for extended periods can foster a culture of prudent investing.

In conclusion, while the Indian mutual fund industry has made remarkable progress since its inception, there remains a vast potential for growth by targeting a wider investor base and promoting sustainable investment practices. By addressing misconceptions, expanding product offerings, and advocating for long-term investment strategies, the industry can unlock new avenues of growth for investors across the country.

Mutual Funds, Sahi hai!

Until next time..